Account Settings

Risk Profile Assessment

Understand your DeFi investing style and get personalized portfolio guidance based on your risk profile.

What is the Risk Assessment?

The Risk Assessment is a short questionnaire that helps you understand whether your current portfolio aligns with your risk tolerance, investment goals, and management style.

Based on your answers, you'll receive one of three risk profiles:

Investor Type | Description | Score |

|---|---|---|

Aggressive DeFi Investor | High-risk, high-return strategies with active management | 0-27 |

Moderate DeFi Investor | Balanced approach mixing growth and stability | 28-54 |

Conservative DeFi Investor | Capital preservation with steady income focus | 55-90 |

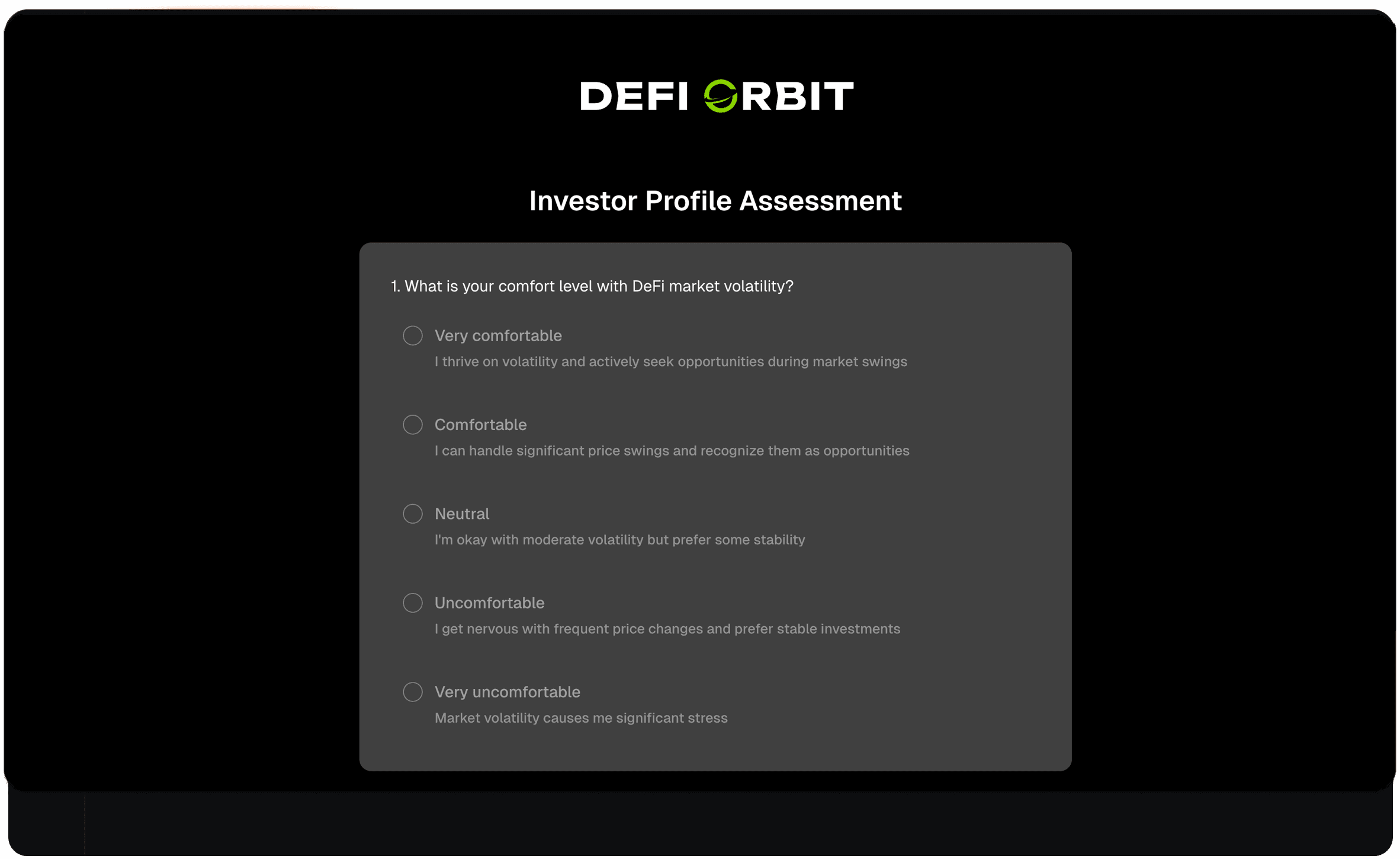

How to Take the Assessment

Navigate to Investor Profile in the main menu

Find the Risk Assessment section

Click Take Assessment (first time) or Retake Assessment (if updating)

Answer the questionnaire honestly based on your actual investing behavior

Review your risk profile results

You can retake the assessment anytime as your strategy or comfort level evolves.

What You'll See After the Assessment

Once you complete the questionnaire, your results page displays:

Your Risk Profile Type Which investor category you fall into (Aggressive, Moderate, or Conservative) with your total score.

Profile Description A summary of what defines your investing style and primary objectives.

Recommended vs. Current Allocation Side-by-side comparison showing:

Your current portfolio breakdown

Recommended allocation for your risk profile

Percentage gaps highlighting where adjustments may be needed

Strategy Approach Specific recommendations aligned with your risk tolerance:

Position management frequency (daily, weekly, monthly)

Preferred chain selection

Fee tier preferences

Protocol selection criteria

Key Metrics to Track Performance indicators that matter most for your investing style.

Risk Management Guidelines Specific practices to help you manage risk effectively based on your profile.

Action Items Personalized next steps based on gaps between your current portfolio and recommended allocation. For example:

"Consider moving 15% from growth positions into core holdings"

"Your stablecoin reserves are below recommended levels"

"Your rebalancing frequency is higher than typical for your risk profile"

Copy Results to Clipboard Save your complete risk profile for reference or sharing.

The Three Risk Profiles

Aggressive DeFi Investor (Score: 0-27)

Characteristics:

Comfortable with high-risk, high-return strategies

Actively manages concentrated liquidity positions

Willing to explore newer protocols and innovations

Primary goal: capital appreciation

Frequent portfolio rebalancing (daily or multiple times weekly)

Typical Portfolio:

25-30% Core holdings (blue-chip assets in active LP positions)

40-50% Growth opportunities (narrow range concentrated liquidity)

15-20% Experimental strategies (newer protocols)

5-10% Stablecoins (for quick entry into opportunities)

Key Focus: Daily yield generation, position range status, fee accumulation rate, impermanent loss vs. fees.

Moderate DeFi Investor (Score: 28-54)

Characteristics:

Balances growth with stability

Mix of concentrated and wider-range positions

Regular monitoring with less frequent adjustments

Combines established protocols with select new opportunities

Weekly position reviews with occasional adjustments

Typical Portfolio:

40-50% Core holdings (established assets, medium-range positions)

20-30% Growth component (selected concentrated liquidity)

15-20% Yield generation (lending on established platforms)

10-15% Stablecoins (for opportunities and adjustments)

Key Focus: Weekly yield trends, position health, protocol TVL stability, portfolio weighted APR.

Conservative DeFi Investor (Score: 55-90)

Characteristics:

Prioritizes capital preservation and steady income

Focus on lending and wider-range liquidity positions

Less frequent position adjustments (bi-weekly or monthly)

Primarily uses well-established protocols

Primary goal: income generation and stability

Typical Portfolio:

50-60% Core holdings (blue-chip assets, wide-range LP positions)

25-30% Income generation (lending on established platforms)

15-20% Stablecoins (capital preservation and flexibility)

0-5% Limited growth (optional small allocation)

Key Focus: Monthly income generated, portfolio stability, protocol security ratings, long-term performance.

How This Helps You

Portfolio Alignment Check Compare your actual portfolio allocation to what's recommended for your risk profile. See exactly where you're over or under-allocated.

Actionable Next Steps Get specific, personalized recommendations based on the gaps between your current portfolio and ideal allocation. No guesswork—just clear action items.

Strategy Validation Confirm whether your current approach (rebalancing frequency, protocol selection, position types) matches your stated risk tolerance and goals.

Identify Misalignments Spot potential issues early. For example, if you're classified as Conservative but hold 60% in narrow-range positions, you'll see a clear warning that your portfolio is riskier than you may be comfortable with.

Informed Adjustments Use the side-by-side comparison to make data-driven decisions about rebalancing toward your ideal allocation.

Join our Discord Server

Any other questions? Get in touch