Core Features

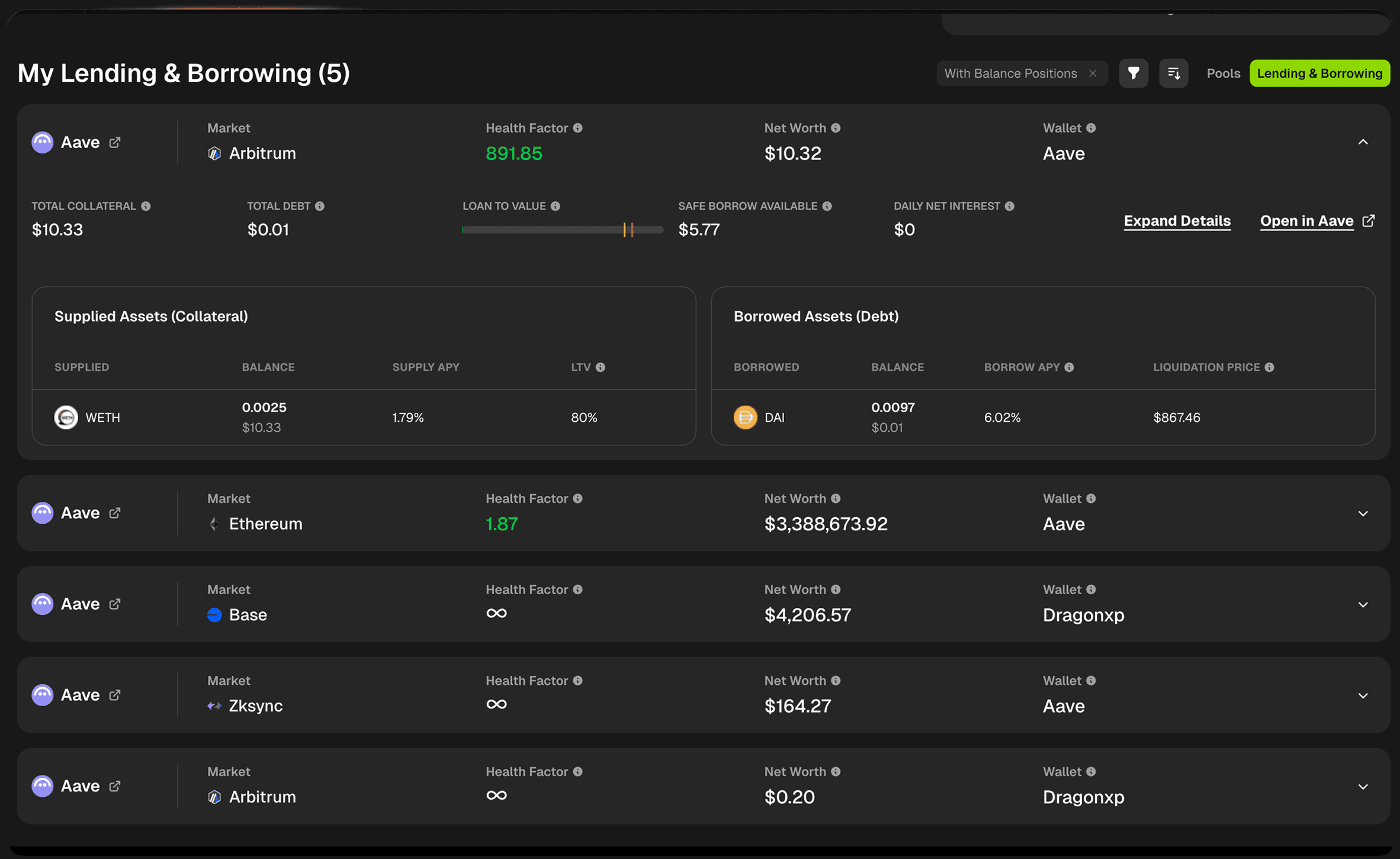

Lending & Borrowing Cards (Dashboard)

Monitor your lending and borrowing positions across protocols with real-time health factor tracking and risk assessment.

Accessing Lending & Borrowing View

From your Portfolio Dashboard:

Click the Lending & Borrowing tab in the position filters

Your view switches from liquidity pools to lending positions

All dashboard metrics update to reflect only lending/borrowing data

Position Card Overview

Each lending/borrowing position card displays key information about your position on a specific protocol and blockchain.

Position Header

Protocol & Market

Protocol logo (e.g., Aave)

Protocol name with external link icon

Market/blockchain indicator (e.g., Ethereum)

Quick Actions

Expand Details - Opens detailed position modal

Open in [Protocol] - Direct link to manage position on the protocol

Key Metrics At a Glance

Value / Metric | Description |

|---|---|

Protocol | Protocol where your collateral is supplied. |

Market | Your protocol's market |

Health Factor | Your liquidation risk indicator |

Net Worth | Total value of supplied assets minus debt |

Wallet | Which connected wallet holds this position |

Top Row Summary Metrics

Metric | Description |

|---|---|

Total Collateral | Total USD value of all assets you've supplied |

Total Debt | Total USD value of all assets you've borrowed |

Current LTV | Your current loan-to-value ratio with visual indicator |

Safe Borrow Available | How much more you can safely borrow |

Daily Net Interest | Your net interest paid or earned per day |

Understanding Current LTV

The LTV Indicator Visual bar showing your current loan-to-value ratio with three zones:

Green Zone (Safe)

Your debt is well below maximum limits

Low liquidation risk

Room to borrow more if needed

Yellow/Orange Marker

Shows your current LTV position

The closer to red, the riskier your position

Red Zone (Danger)

Approaching liquidation threshold

High risk of liquidation if prices move against you

LTV Tooltip Information:

Maximum LTV (e.g., 77.89%)

The highest LTV ratio your debt can reach as a percentage of your total collateral

This is NOT your liquidation point

Warning threshold before liquidation

Liquidation LTV (e.g., 80.54%)

The debt-to-collateral ratio at which your position CAN be liquidated

If your LTV reaches this level, liquidators can close your position

Always maintain LTV well below this threshold

Supplied Assets (Collateral) Table

View all assets you've supplied to the lending protocol:

Column | Description |

|---|---|

Supplied | Which token you've deposited as collateral |

Balance | Token amount + USD value you've supplied |

Supply APY | Annual percentage yield you're earning on this asset |

LTV | Loan-to-value ratio for this specific asset (how much you can borrow against it) |

Why Supply APY Varies: Different assets have different supply rates based on:

Protocol utilization

Asset risk profile

Market demand for borrowing that asset

Understanding Individual Asset LTV:

Higher LTV (e.g., 80%) = Can borrow more against this asset (usually stablecoins or blue chips)

Lower LTV (e.g., 65%) = Can borrow less (riskier or more volatile assets)

Borrowed Assets (Debt) Table

View all assets you've borrowed from the protocol:

Column | Description |

|---|---|

Borrowed | Which token you've borrowed |

Balance | Token amount + USD value of your debt |

Borrow APY | Annual interest rate you're paying on this loan |

Liquidation Price | Price at which this specific asset would trigger liquidation |

Why Borrow APY Varies: Borrow rates change based on:

Protocol utilization (more borrowing = higher rates)

Asset volatility

Market demand

Understanding Liquidation Price:

If the borrowed asset's price reaches this level, you're at risk of liquidation

Monitor this closely for volatile assets

Multiple borrowed assets = multiple liquidation prices to track

Join our Discord Server

Any other questions? Get in touch